Más de 40 años de experiencia en el mercado

Trayendo a Panamá marcas de todas partes del mundo.

Visita Nuestro Dicsa Market

Encuentra todas nuestras marcas en un solo lugar a los mejores precios.

Los mejores productos para el cuidado de tu auto

Más de 40 años de experiencia en el mercado

Trayendo a Panamá marcas de todas partes del mundo.

Visita Nuestro Dicsa Market

Encuentra todas nuestras marcas en un solo lugar a los mejores precios.

Los mejores productos para el cuidado de tu auto

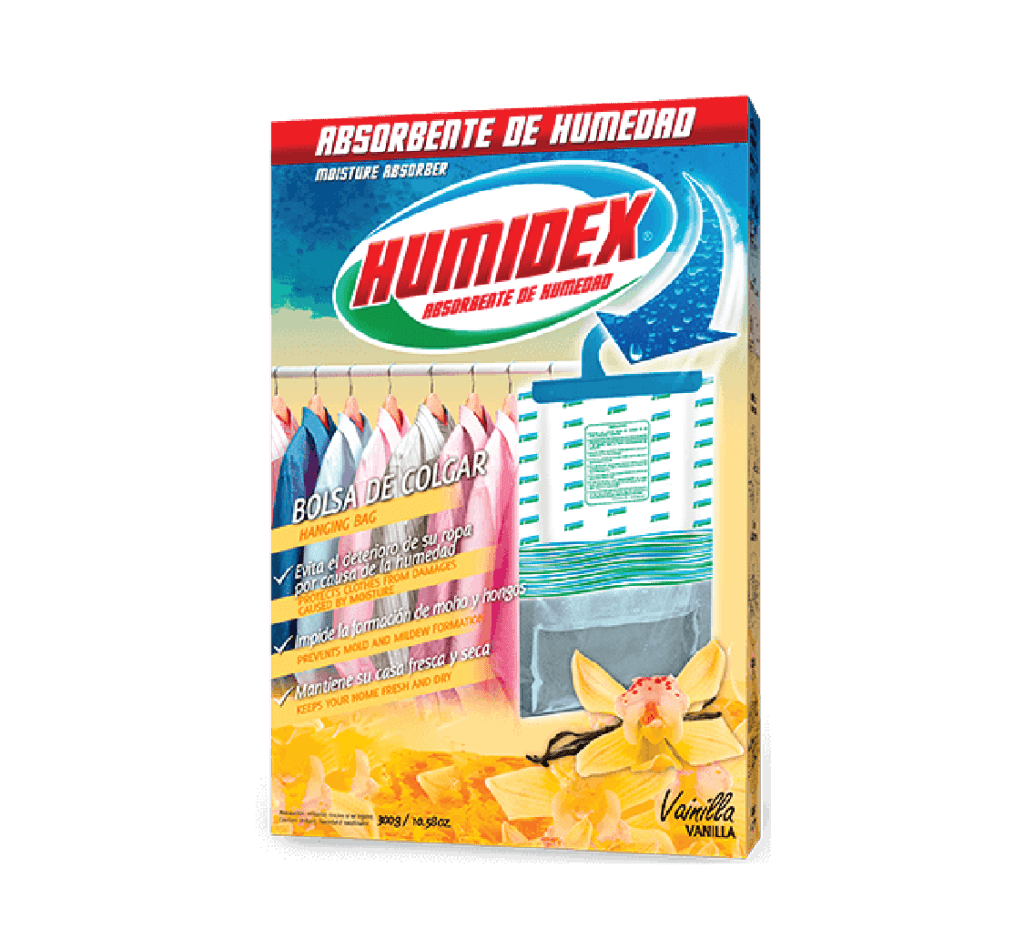

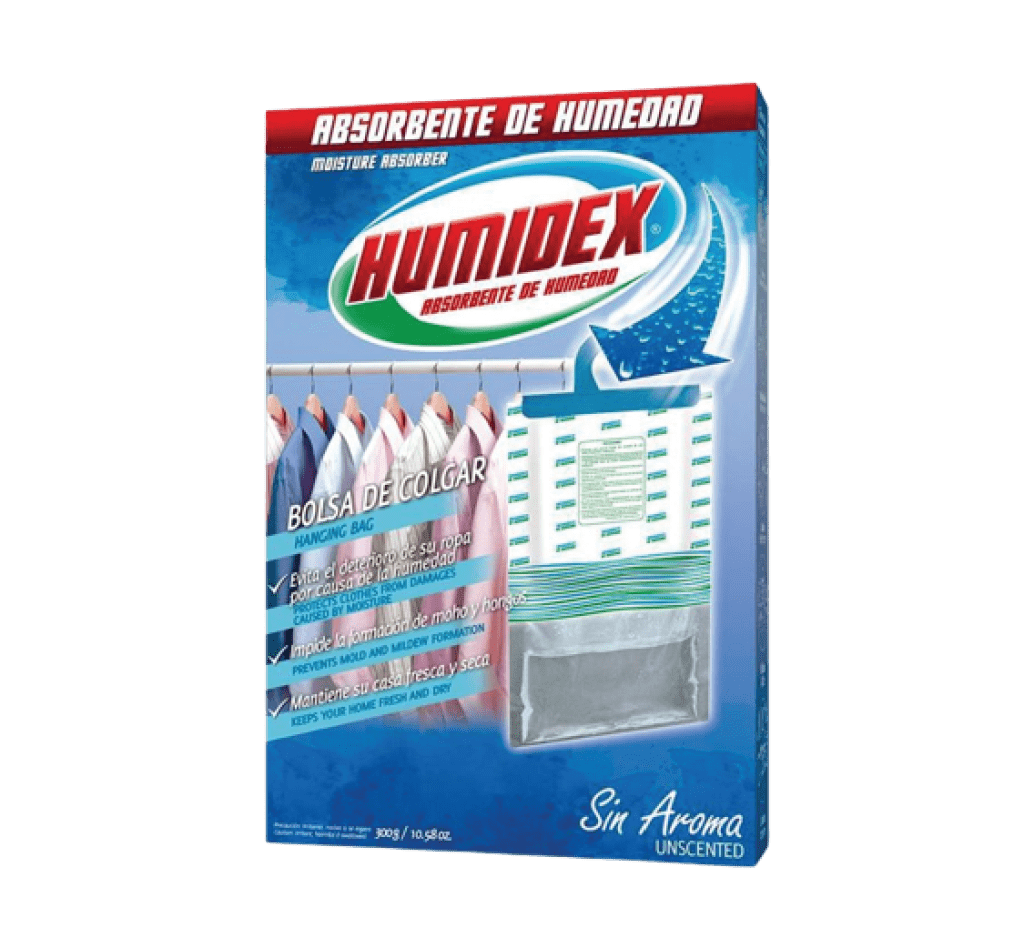

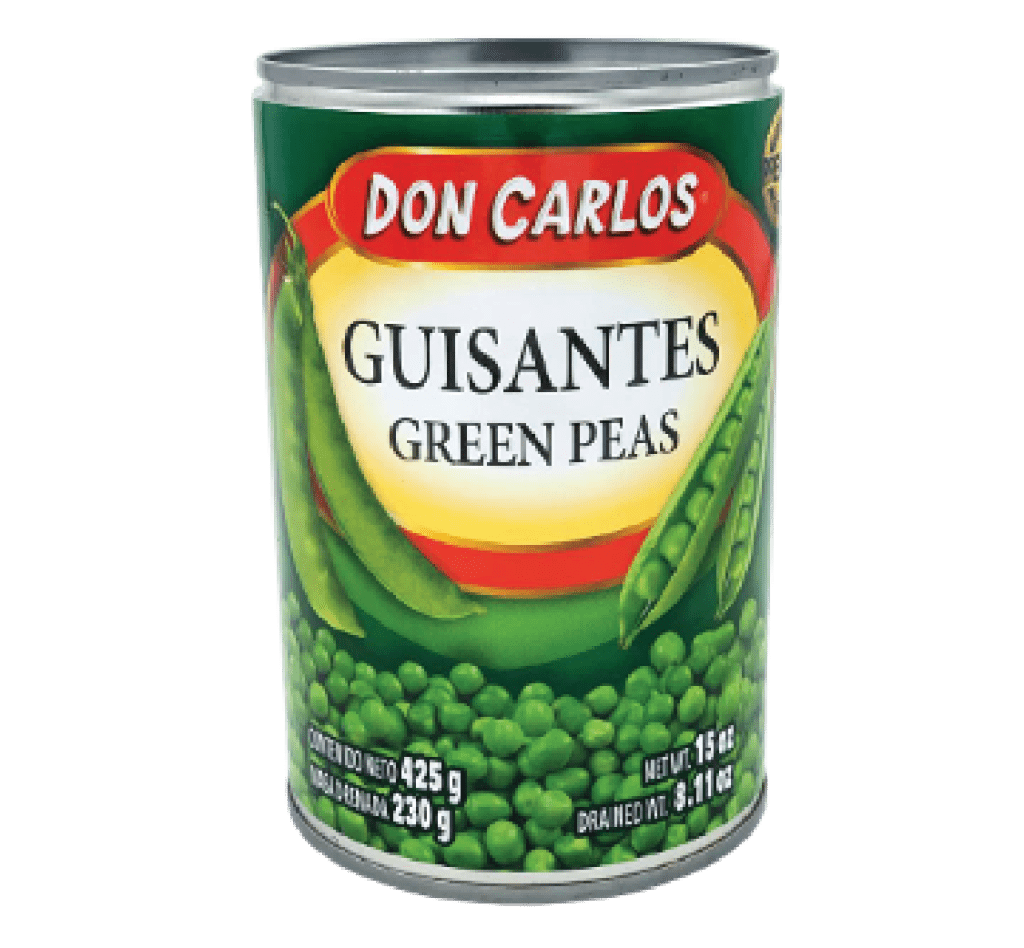

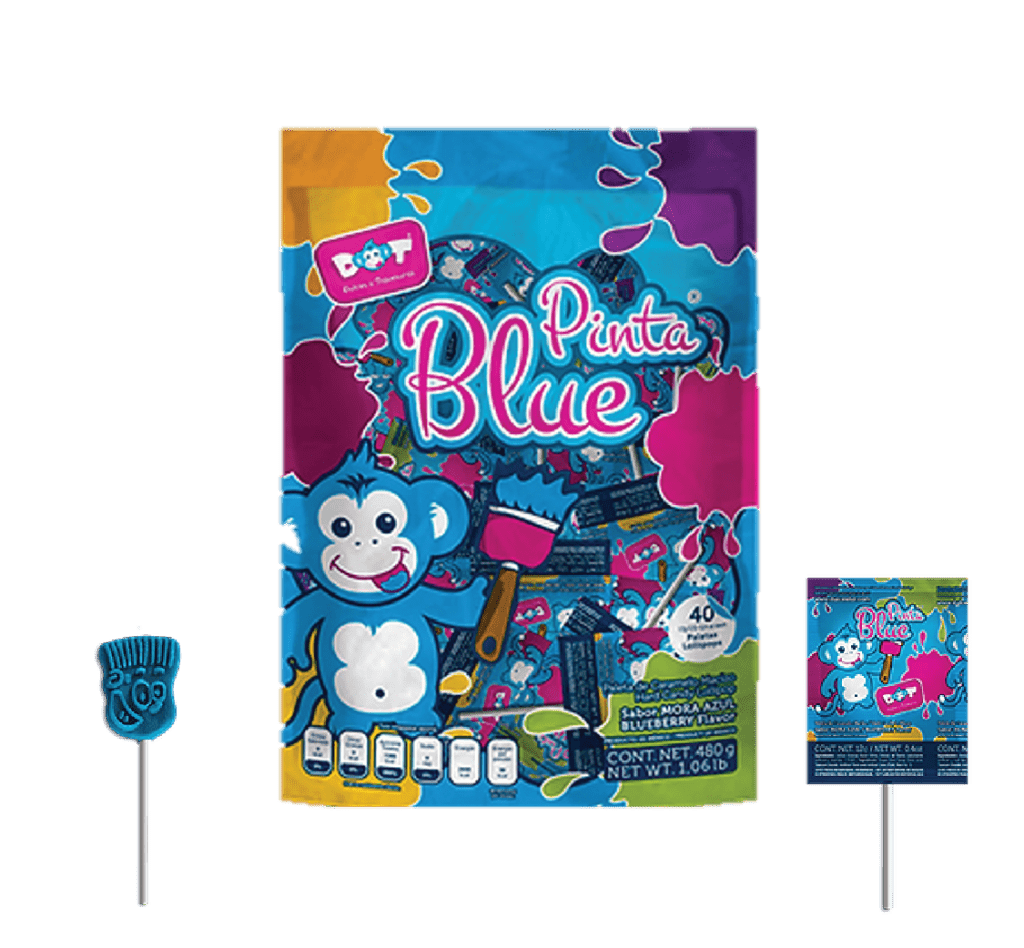

Nuestros productos y marcas destacadas

Nuestras Marcas

Es un lubricante multipropósito conocido como el producto de los 2000 usos. La versátil y eficaz fórmula se convierte indispensable para el mantenimiento a nivel industrial, profesional y doméstico.

Marca líder e innovadora en el sector automotriz con productos especializados para el cuidado del interior y el exterior del auto. Mantén tu auto mas limpio por más tiempo con los productos de Armor All.

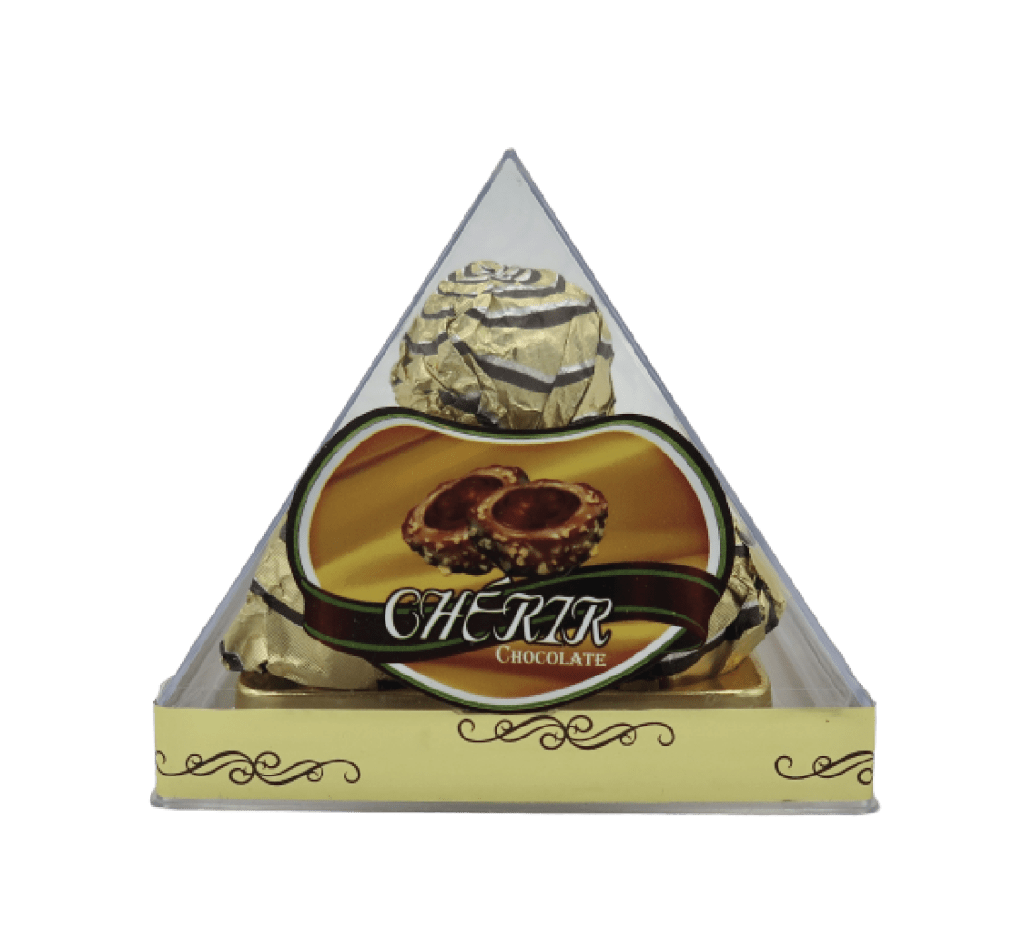

La línea más colorida y divertida de golosinas, galletas, juguetes y chocolates. Con Candies Supplier encontrarás las mejores novedades en dulces.

Es una línea de caramelos de menta para refrescar el aliento y reducir la tos, desarrollados con verdaderos ingredientes que deleitan tu paladar.

Cuatro décadas después, DICSA es una empresa líder en importación y distribuición de productos en el mercado panameño, distribuyendo marcas reconocidas de todas partes del mundo